The last decade alone has seen changes in the banking and financial services sector like never before, with the FinTech industry at the epicenter of this reinvention. Even mundane daily tasks such as ordering groceries online to purchasing your brand new phone off the Internet revolves around the radical transformations of the financial industry. FinTech trends are all set to impact pretty much everything that involves money, from payment to banking to even buying new insurance.

In the last few years, a significant number of companies have allocated a dedicated workforce and resources towards modifying fintech products and services exclusively developed for specific functions within the financial ecosystem. Some famous examples include InsurTech, RegTech, and Robo-advisor. Given these advancements, it is no longer a question of “Will Fintech change how the financial industry works?” It’s more about how.

So, what major changes can you expect from the Fintech industry in 2020?

Will Fintech replace banks?

A [study carried out by CACI] showed that the number of people visiting their nearest bank to conduct any financial transaction is set to drop by 36% before 2022. On the one hand, banks are looking to cut down on their costs, and one of their highest costs is technology. For instance, banks such as HSBC and NatWest experienced technical outages in 2019, because they did not upgrade their technology. By using Fintech and implementing digital-only banks, this cost is significantly lowered.

How IT decision makers will build their tech teams after 2020

DOWNLOAD GUIDEOn the other hand, is the customer experience. By using a digital-only bank, a customer doesn’t have to visit the bank personally, stand in a long line that leaves them flustered and annoyed, and they don’t have to deal with the agonizing mountain of paperwork. By opting to use a digital bank, you can reset your ATM pin at the comfort of your home, track and manage your expenses via an app, and pay your bills within a minute or two.

So the big question here is – Will the Fintech industry revolutionise how banking is done? By the looks of it, that’s quite the possibility.

FinTech and Globalisation

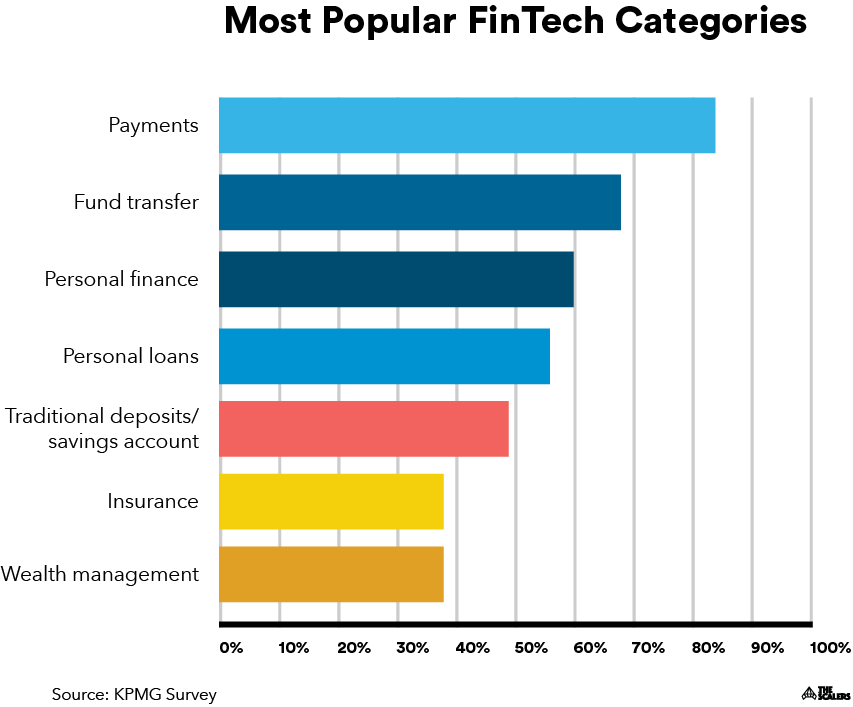

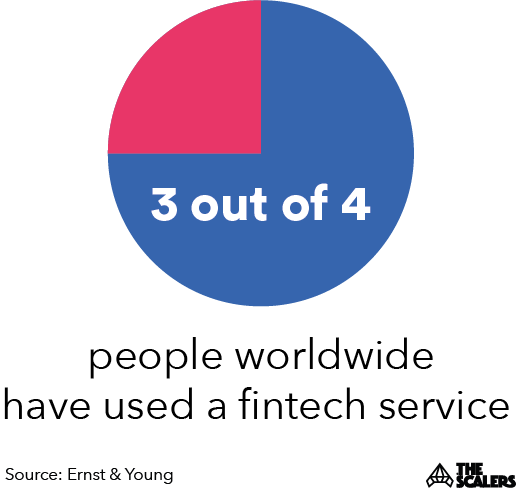

According to the Global Fintech Adoption Survey conducted in 2019, a whopping 96% of the respondents surveyed were aware of at least one fintech service. 75% of the respondents had used either a fintech product or service or a fintech app to transfer money. This clearly indicates that the Fintech industry is no longer on the sidelines but is becoming a globally known industry.

For instance, in 2019, the number of fintech deals in Asia spiked so high that it almost overtook the US according to the CB insights. On the other hand, even countries like Africa and Brazil saw the number of fintech investments exponentially increase in the last couple of years. However, more importantly, Fintech is allowing ideas that originate in one location to be improved and evolved in another. Fintech players are now scaling across borders, and the globalisation of the industry is accelerating like never before.

Artificial Intelligence in FinTech

If Fintech on its own wasn’t disrupting the financial services industry enough, implementing Artificial Intelligence in the fintech industry can be a real game-changer for businesses across the globe.

Almost every other application that uses AI on a consumer-level requires some level of payment, which is where Fintech will prove to be indispensable. Because AI has the potential to eliminate any form of human error in banking procedures and understand the average consumer’s demand, it can seamlessly be integrated into e-commerce applications that use fintech payments, in turn, bringing about an AI-first digital revolution.

Similarly, the InsurTech industry requires IT technologies such as Artificial Intelligence, predictive analysis, and big data processing. AI can minimise not only the number of InsurTech errors but also provide easy-to-use algorithms that can bring about more accurate risk prediction and, thus, improve the overall quality of the service that the consumer receives. Further, Big Data and Predictive analysis are pushing the boundaries for more fintech companies to offer personalised products for B2B and B2C clients. With the number of openings for data scientists and experts in the field of Fintech predicted to exceed 2.7 million in the US alone, it is now time to explore offshore talent to scale your team as quickly as possible.

Decentralised financial systems

A decentralised financial system is one of the emerging trends of the Fintech industry, where companies apply technologies such as distributed ledgers, online P2P platforms, IoT, or edge computing to process monetary interactions.

This emerging trend is already changing how settlements and payments are being done on a day-to-day basis, as peer-to-peer foreign currency exchange platforms are now implementing similar processes as that of long-established interbank payment systems. Further, decentralized financial technologies are likely to affect trade finance, capital markets, and lending, because of the need to provide quick services at lower prices.

in Bangalore

Speed up your software delivery with an integrated and dedicated team

LEARN MORECryptocurrency and Blockchain

Though the move towards using blockchain and cryptocurrencies in the financial services industry was a slow one, it was as steady as can be. Today, on average, the financial services industry spends over $1.7 billion every year on blockchain technology – a trend that is only going uphill. Data aggregated from PwC’s survey also shows that 77% of officials in top management positions expect to adopt blockchain as part of their production process by the end of 2020.

For instance, the use of blockchain in digital identity management provides additional security for both consumers and businesses. Financial institutions use blockchain to promote asset and money transfers, payments, and investments, and consumers use the service because of the speed and security that it provides.

If you’re looking to build a team of FinTech developers, feel free to reach out to us by filling out the contact form. One of our senior executives will get back to you shortly. We’ve successfully built the best development teams for our FinTech clients, and we’re sure we can build your A-team too!