- Bangalore has evolved from government-planned tech parks in the 1990s to a global innovation hub that accounts for 42% of India’s IT exports.

- With ~2 million software developers, 900+ Global Capability Centres (GCCs) across Karnataka (most of them in Bangalore), and 32 active unicorns, the city offers unmatched talent density at scale.

- Companies building offshore teams in Bangalore gain access to engineers with deep domain expertise across finance, healthcare, logistics, and automotive, among other sectors.

- Bangalore’s technical quality and R&D infrastructure make it the top IT offshoring destination among Indian cities like Hyderabad and Chennai, as well as tech hubs in LATAM and Eastern Europe.

When talking about India and how it has become one of the global tech hotspots, Bangalore always comes up as the city that propelled the country to the next level.

Vast engineering talent pool, dynamic startup ecosystem, modern infrastructure, investment from global tech giants… the city has it all! That’s why many consider Bangalore an ideal IT offshoring destination.

At The Scalers, we’ve been building offshore teams by sourcing talent from Bangalore’s rich tech talent pool for the past decade. We’ve watched the city grow throughout the years. In this article, we guide you through how this tech hub became what it is today, compare it to other hubs in India and around the world, and explain why it remains a top location to set up and scale your offshore team.

How Bangalore became a top IT offshoring destination

Six decades of government investment and policy timing turned Bangalore, a garden city known for its parks and greenery, into the ‘Silicon Valley of India.’

This is how it all happened:

- 1960s-70s. Defence and aerospace companies like ISRO, HAL, and BEML set up operations, bringing thousands of engineers to the city and establishing its technical reputation.

- 1984. India liberalised its computer and software policies, opening export markets for companies like Wipro and Infosys.

- 1985. Texas Instruments became the first multinational to open a development centre in Bangalore.

- Early 1990s. The government launched Software Technology Parks of India (STPI), with Bangalore as the pilot location.

- 2000s. The city evolved from an outsourcing hub to an innovation centre. Microsoft, IBM, and Cisco opened R&D facilities for core product development.

- 2010s. A startup boom with Flipkart, Ola, and Razorpay raising billions in funding. Startup careers became as attractive as working in corporate roles at multinationals.

- Post-2020. Remote work validation during COVID-19 accelerated offshore hiring. Bangalore now hosts 2,400+ startups and accounts for 42% of India’s IT exports.

Deepak Arunachalam, COO & Partner at The Scalers, has watched this transformation firsthand: “The biggest change I’ve seen in the past 10-15 years is that Bangalore hasn’t just grown but strengthened itself as the place to work in IT in India. Engineers find better salaries and the most exciting professional opportunities in the country.”

The city’s dominance isn’t accidental. The talent density, the mix of mature companies and startups, the infrastructure – all these factors compound. “There are not many incentives for companies to move to other cities when everything they need is already here,” Deepak adds. “Better talent concentration, higher quality opportunities, and the ecosystem effects you get from having everyone in one place. You can’t replicate that overnight.”

Bangalore in 2025: The current IT offshoring landscape

We’ve already covered Bangalore’s timeline from the 60s to the 2020s, during which it established itself as India’s most renowned IT offshoring destination and tech hub.

Now, where is the city today, and where is it heading?

Before diving into specific market data on roles and examining the state of the city’s startup ecosystem, let’s look at the numbers that define Bangalore’s IT offshoring landscape in 2025:

- ~2 million software developers live and work in Bangalore, making it one of the largest concentrations of tech talent in a single city globally.

- 90,000 new engineering graduates join the city’s talent pool every year from local universities, ensuring continuous talent renewal.

- Bangalore is the world’s second-largest AI talent hub with 600,000 AI/ML professionals, and ranks #5 globally among Top AI cities.

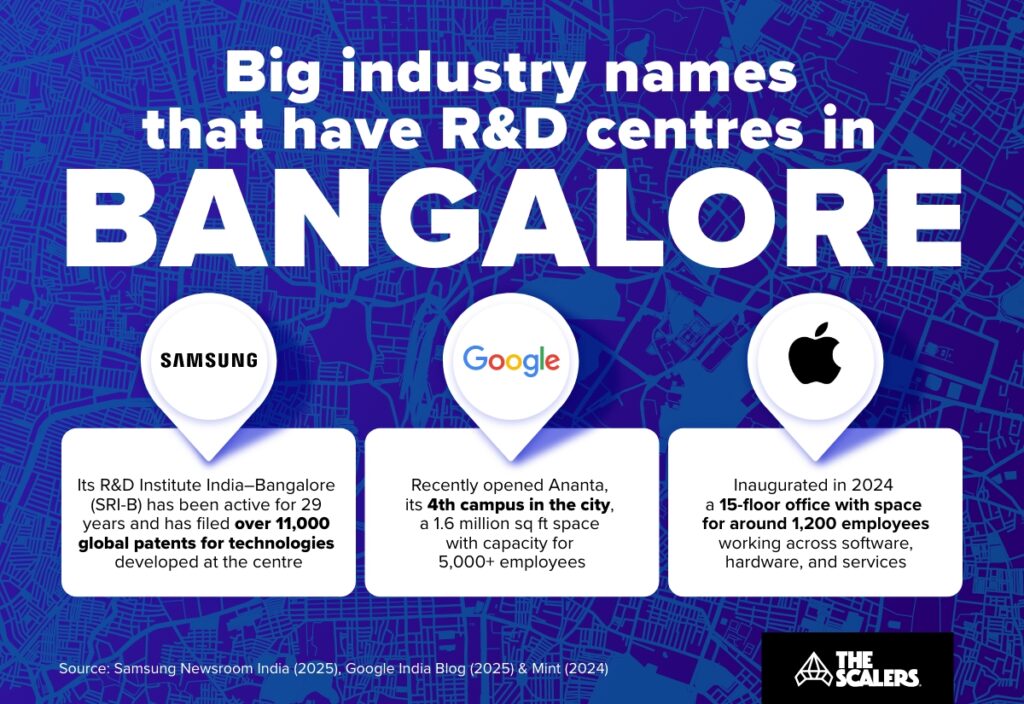

- 400+ R&D centres from multinational corporations like Google, Amazon, and Microsoft operate here.

- Over 40% of India’s 1,750+ GCCs are in Bangalore, employing over 800,000 professionals.

These numbers aren’t static. They represent a city in constant expansion, where demand continues to outpace supply, and infrastructure keeps improving.

Bangalore IT offshoring market data (roles, demand, and salaries)

Bangalore’s tech ecosystem supports massive role-specific demand across specialised positions. While exact numbers are challenging to pinpoint, given the city’s dynamic nature and constant growth, internal data, AIM Research reports, and job portals like LinkedIn provide a strong estimation of current demand today:

- 30,000+ software developer positions available daily across platforms.

- 10,000+ data engineer job openings are actively being filled across the city.

- 9,000+ DevOps engineering roles in demand.

It’s worth mentioning that AI-first roles are already having a significant impact on new tech openings. Some of the roles listed above require professionals with experience in AI/ML engineering.

As for salaries, software engineers in Bangalore earn between $24,400 and $64,000 (₹20.5-53.8 lakhs) annually, with senior engineers commanding $42,400 to $90,400 (₹35.6-75.9 lakhs).

These salary ranges reflect Bangalore’s position as a top IT offshoring destination, offering significant cost advantages to Western organisations. As detailed in our analysis of offshore savings, companies from the US, Europe, and Australia can expect savings of 25-40% on total costs per engineer when building offshore teams in Bangalore.

Bangalore’s thriving startup ecosystem

It would be unfair to talk about Bangalore’s IT offshoring landscape without mentioning its startup ecosystem. These companies have become exceptional training grounds for young engineers, who gain valuable experience in scaling systems, handling rapid growth, and building under resource constraints – skills that translate directly into offshoring contexts.

As per The Global Startup Ecosystem Index Report 2025, this is the state of Bangalore’s thriving startup ecosystem:

- The city has 2,363 startups, accounting for 23% of all startups in India.

- It’s home to 32 active unicorns, including Swiggy, Meesho, and Razorpay.

- It’s ranked as the #1 startup ecosystem in India and #10 in the world.

One of the major pushes for startups to grow over the past decade has been government initiatives such as the Karnataka Startup Policy 2015-2020, which offered high-impact incentives, including seed funding of up to ₹50 lakh to support product development and patent reimbursements of up to ₹10 lakh for global IP protection.

Bangalore vs other top IT offshoring destinations

When companies weigh offshoring options, they’re usually comparing countries: India versus the Philippines, or Eastern Europe versus Latin America. But Bangalore flips that logic. This single city rivals the combined tech capacity of entire regions.

The talent density here is staggering. Bangalore has a tech talent pool of 2 million software developers, exceeding the combined developer populations of Poland and Romania!

Competing within India: Hyderabad, Pune, Chennai, and Gurgaon

Bangalore is not the only major IT offshoring destination in India. Hyderabad, Pune, Chennai, and Gurgaon are also popular tech hubs:

- Hyderabad is India’s second-largest IT exporter, driven by proactive government policies and the HITEC City/Cyberabad infrastructure. The city achieved IT exports worth Rs. 2.68 lakh crore ($32.2 billion) in FY24, with a workforce of 9.46 lakh employees (11.2% year-over-year growth). Major players like Microsoft, Amazon, and Google have established operations here.

- Chennai ranks as India’s third-largest IT exporter and has a strong automotive and manufacturing sector. The city’s SaaS ecosystem includes 92 top companies generating $2.4 billion in combined revenue and employing 37,100 people, anchored by giants like Zoho and Freshworks.

- Pune is considered Western India’s IT capital, hosting major hubs in Hinjewadi, Kharadi, and Magarpatta. Pune’s proximity to Mumbai and strong educational base (dubbed the “Oxford of the East”) have created a solid foundation, though the startup ecosystem and niche technical expertise are narrower than those in Bangalore.

- Gurgaon functions as a corporate headquarters capital within the Delhi NCR, and it hosts over 500 IT companies and Fortune 500 giants, including Google, Microsoft, IBM, Deloitte, and TCS.

Still, Bangalore remains unmatched in scale and depth. Approximately 35% of India’s tech workforce is located in Bengaluru, compared with 20% in Hyderabad and 10% in Chennai. This concentration allows Bangalore to dominate niche areas such as fintech, cloud, and AI/ML, making it the go-to destination for specialised talent.

Deepak puts it bluntly: “In Bangalore, if we’re hiring for engineers with experience in sectors like legal tech or insurance, we can easily find around 100,000 active candidates with the relevant background. The scale, volume, and talent opportunities here are amazing.”

International alternatives: The Philippines, Eastern Europe, Latin America

The global competition for offshoring work has intensified over the past decade, with regions such as Eastern Europe, Latin America, and Southeast Asia positioning themselves as viable alternatives to India’s dominance.

Each IT offshoring destination offers distinct advantages in cost, talent depth, and operational compatibility:

- Eastern Europe commands premium pricing but delivers strong technical skills and cultural alignment with Western teams. Poland hosts 600,000 developers across Warsaw and Kraków, with hourly offshore software development rates ranging from $40 to $56.

- Latin America offers geographic proximity to the US and a favourable time zone overlap. Mexico brings 500,000 developers across Guadalajara and Monterrey at $30 to $50 per hour, making real-time collaboration with American teams straightforward. Colombia is home to 150,000 developers in Bogotá and Medellín at $25 to $45 per hour, with growing government support for tech investment.

- Southeast Asia balances affordability with English proficiency. The Philippines has 190,000 developers concentrated in Manila and Cebu City, charging $20 to $40 per hour.

Despite lower costs being one of the main reasons companies consider offshoring, the real advantage is what you get for that price at scale. “The value-to-talent ratio is best in Bangalore at scale. If you go to places like Vietnam or the Philippines, you face more trade-offs. It’s harder to find the same quality”, says Deepak.

The Scalers once explored opening operations in the Philippines. The experience revealed important distinctions that hourly rates alone don’t capture. Deepak explains: “We realised that on average, the education level and ability to handle complex technical work isn’t as strong as in Bangalore. Finding well-educated engineers in the Philippines means competing for a small pool of top talent, which drives their rates up significantly in those markets. In Bangalore, because the talent pool is so massive, even highly skilled engineers remain affordable. For raw engineering talent at scale, no country compares to India, and Bangalore specifically.”

Why Bangalore? 5 factors that make it the top IT offshoring destination

These are the top five reasons why Bangalore is considered by many to be the top IT offshoring destination for building and scaling teams:

Cultural openness and quality of life

Bangalore has always been different from the rest of India. The city developed an open-minded, Western-friendly culture dating back to when it served as a refuge for British officials seeking cooler weather than Chennai or Mumbai. That legacy translates into today’s work environment.

The city pioneered India’s going-out culture – bars, parties, and social scenes that made it feel cosmopolitan decades before other Indian cities caught up. Southern India tends to be wealthier, with stronger social infrastructure and better quality-of-life indicators than northern states. Bangalore offers safety, social diversity, and a welcoming attitude toward outsiders that makes it easier for international companies to establish operations.

“Bangalore is open to a Western mindset in ways that matter for business,” Deepak notes. “The culture of people coming from outside to do work is deeply embedded here. You see that in everything from how people communicate to how they approach problem-solving.”

Corporate infrastructure and business-friendly policies

The State of Karnataka is business-oriented and industrial-friendly. That translates into infrastructure advantages that matter when you’re building an offshore team.

For instance, the first offshoring centres in India opened in Bangalore. The state provided tax breaks, initiatives to set up campuses, and the ability to hire at scale without bureaucratic friction. Companies gained influence around taxation and education policy, incentivising colleges to teach specific technologies and creating guaranteed job pipelines for graduates.

The density of product companies and IT services firms in Bangalore surpasses any other Indian city. Everything here is more fluid: it’s easier to be employed, network with like-minded people, and grow professionally. That dynamism benefits organisations considering building teams in the city.

“Many of the biggest CEOs of major Indian companies like Infosys originally come from Bangalore,” Deepak adds. “There’s an entire generation of tech leaders who built their careers here and stayed.”

Government support and national significance

Incentives and tax breaks in the early 2000s to export services from Karnataka made Bangalore a preferred location. While those specific incentives have become less relevant as other states have caught up, the foundation they built remains.

In September 2024, Karnataka unveiled its GCC Policy 2024-2029, aiming to attract 500 new centres by 2029, create 350,000 new jobs, and generate $50 billion in economic output. The policy offers capital investment subsidies up to 25%, infrastructure grants up to ₹50 million, and support for R&D initiatives.

Bangalore hosts some of India’s most strategically important institutions, such as nuclear development facilities, flight development centres, and defence research organisations. This creates a technical ecosystem that extends beyond commercial software into deep engineering domains.

“The best tech talent in India has been in Bangalore for 10-15 years already,” Deepak observes. “They’ve built lives here. There’s a strong belonging to the city that’s hard to replace. And with industry bodies like Nasscom and supportive government policies continuing to fuel India’s tech ecosystem, Bangalore remains one of the country’s most important innovation hubs.”

Unmatched talent pool and demographic advantage

India is home to 5.8 million software developers, and the best of the bunch live and work in Bangalore.

The broader ecosystem supporting this talent pool is equally strong. India’s tech industry crossed $283 billion in revenue in FY25, growing 5.1% year over year, with $224 billion in exports. Karnataka alone contributes $65 billion in IT exports, underscoring Bangalore’s role at the centre of India’s tech industry.

One defining factor that sets India and Bangalore apart from other IT offshoring destinations is the country’s demographics. “75% of India’s population is under 35 years old. The majority of the country is young, dynamic, and motivated for long-term careers in technology”, highlights Deepak. “This creates a pipeline that simply doesn’t exist in ageing economies like Japan or most European countries.”

GCC ecosystem

India hosts 1,750+ GCCs employing nearly 1.9 million people, with Bangalore accounting for over 550 of these centres.

The mid-size segment shows this concentration even more clearly: Karnataka hosts 230+ of India’s 480 mid-size GCCs, proof that companies seeking flexibility and specialised talent choose Bangalore.

And once they’re here, the ecosystem multiplies in value. Talent moves between centres, taking best practices with them. Around the GCC hubs, consulting partners, service providers, and vendors cluster closely, providing companies with everything they need to scale quickly and operate at a high level.

The benefits of building an R&D centre in Bangalore

Companies establishing R&D operations in Bangalore gain access to engineers who’ve worked on ambitious products for global tech giants.

If you decided to build an R&D centre in Bangalore, you’ll benefit from:

- Access to top-quality, specialised talent. Need software engineers experienced in cloud platforms, mobile apps, or AI/ML applications? Frontend and backend engineers who have shipped products at scale? Data engineers who can handle large datasets? Bangalore’s deep talent pool allows you to fill these roles faster than in other tech hubs.

- Proximity to premier institutions. IISc, NITK, and around 200 engineering colleges continuously feed the talent pipeline. Companies can establish campus recruitment programs, sponsor research projects, and hire interns before competitors.

- A mature vendor ecosystem. Cloud infrastructure partners, QA and security testing firms, design agencies, hardware labs… almost every supporting capability already exists in the city. This allows R&D teams to scale or bring in niche expertise without long procurement cycles or vendor searches.

- Cost arbitrage for experimentation. R&D requires trying approaches that might fail. Bangalore’s labour and operational costs are lower than in cities like San Francisco or London, which allows teams to experiment more freely, iterate faster, and test more hypotheses without inflating budgets.

How The Scalers can help you build a world-class offshore team in Bangalore

Building a successful offshore team is about more than just choosing the right IT offshoring destination. You also need an offshore development partner who understands both your business objectives and the local ecosystem from which you’re hiring top talent.

Your offshore partner can make a real difference, helping you cut costs by 25%, maintain 99.99% uptime, and deliver critical features faster while keeping your team aligned with your company’s culture.

That’s exactly what we specialise in. At The Scalers, we build dedicated offshore teams in Bangalore with world-class Indian engineering talent. We’ve helped companies scale from initial teams of 5 engineers to offshore development centres with 100+ specialists, maintaining quality and cultural alignment.

We wanted to have our own team and make it very ‘Preqin’ and we wouldn’t have been able to build that team so quickly without The Scalers. They handled all of the hassles so we could spend our time building quality software and collecting quality data. And we wouldn’t have grown as Preqin without the team in India.

Are you ready to set up an offshore team in Bangalore with engineers committed to your business and long-term success? Send us a message, share your unique needs, and one of our senior executives will contact you shortly.

FAQs

IT outsourcing involves hiring an external company to handle specific tasks or projects, typically on a short-term basis. IT offshoring is about building a long-term, dedicated team in another country with engineers who work as part of your company.

India is one of the top destinations for IT offshoring, thanks to tech hubs like Bangalore. Other popular offshoring destinations include countries like Poland, Romania, Colombia, Brazil, and the Philippines.

Some of the top IT companies headquartered in Bangalore include Wipro and Infosys. There are also R&D centres for global giants such as Amazon, Microsoft, Meta, and Google.

The future looks bright. Global Capability Centres (GCCs) are continuing to expand in cities like Bangalore, meaning offshoring will be more about higher‑value roles (R&D, AI, cloud) rather than just cost arbitrage.

Build Your Team,

Not Just a Contract

With The Scalers’ offshore dedicated development team, you get engineers who join your workflow for the long run. Grow steadily, stay flexible, and work with people who care about the product as much as you do.