Lately, it seems that all everyone talks about is AI-related. Especially when analysing digital transformation trends.

While generative AI and machine learning are expected to play a critical role in organisations’ development in the foreseeable future, these aren’t the only innovations you should keep an eye out for.

In this article, we’ve gathered the top 11 digitalisation trends every tech or business leader should know for 2025… and what’s to come.

But first, let’s start by defining what digital transformation (really) is and why many companies decide to extend their dev teams offshore to better execute long-term strategies and drive growth.

What is digital transformation?

Digital transformation is the process of implementing digital technologies to create or modify business processes and enable positive change internally and externally.

For example, an organisation might switch to cloud technology to simplify data storage and allow teams to access information from anywhere. This transition can also improve customer service by enabling faster responses and smoother collaboration with external partners.

To reach their digital transformation goals, some companies opt to go offshore and build elite teams abroad. Offshoring for digital transformation offers them benefits such as accessing a global talent pool and achieving cost optimisation and increased efficiency — all essential to staying competitive and innovating in their industries.

Top 11 digital transformation trends for 2025

After thorough research, we’ve compiled a list of the digital transformation trends shaping businesses in 2025, including quantum cryptography and eco-conscious strategies, among others.

1. Generative AI for business decision-making

If you read any article on digital transformation trends post-2022 (or even earlier), you’ll see that generative AI is one of the main topics being analysed.

Today, two years after the public release of ChatGPT — the generative AI chatbot that changed everything — the topic of discussion is not about predicting the capabilities of this technology but how it can influence business decisions.

Starting in 2025, generative AI will likely be used for more than just writing business emails or brainstorming marketing campaigns. Companies will leverage AI to analyse trends, forecast market shifts, and even develop custom AI models to support strategic decision-making.

For instance, Fusion Risk Management, a US software company, has developed a new AI-powered assistant called Resilience Copilot. This tool aims to help organisations manage operational risks by automatically analysing large amounts of data, identifying key issues, and providing recommendations to decision-makers.

2. Quantum cryptography

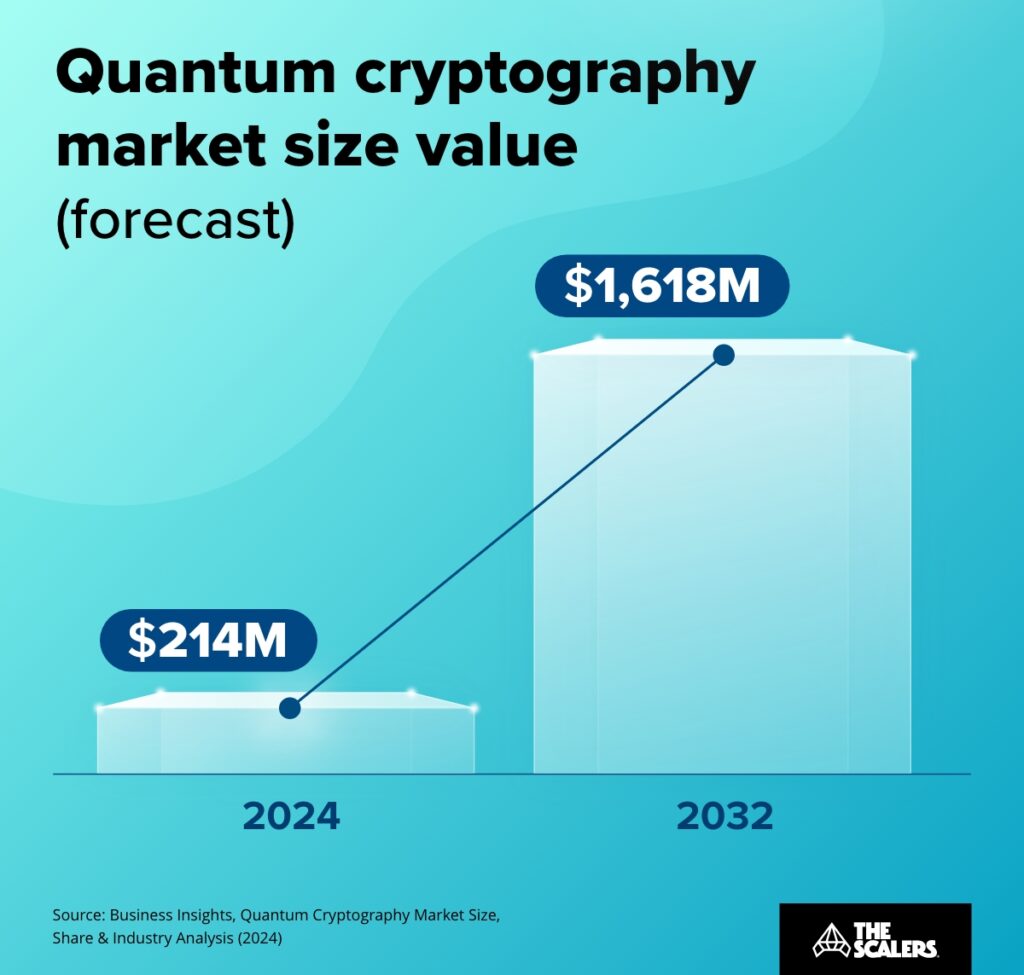

Quantum cryptography is an encryption method used to transmit data securely using the principles of quantum mechanics. Also known as quantum encryption, this technique is still in its early stages but is expected to revolutionise cybersecurity in all industries gradually.

Companies like ID Quantique are already offering quantum-safe security solutions for organisations that want to anticipate the cyber threats that will become the norm when quantum computing becomes universally available.

This field is especially relevant to banks and financial institutions, as it is poised to drive digital transformation in FinTech for years to come.

3. Low-code and no-code development

Due to its complexity, software development will (probably) always be a field where only highly technical professionals can shine. However, low-code and no-code development are making it easier for dev and non-dev teams to participate in building tech.

These app development processes are already transforming how teams work together within companies. For example, a Product Manager can now collaborate with engineers to quickly build and iterate on features, using no-code platforms to test ideas without coding.

4. Automation of business operations

Automation is closely connected to some of the trends we’ve covered, such as AI and low-code and no-code tooling.

While not a new shift, in 2025, organisations will keep handing over manual and repetitive tasks, once performed by humans, to programs or robots. Indeed, 53% of decision-makers say their organisations are investing in robotic process automation (RPA).

All industries stand to benefit from automation, but manufacturing companies undergoing digitalisation are likely to make the largest investments and see the greatest returns.

5. Eco-conscious strategies

Tech companies are expected to double down on environmental sustainability as they integrate it into their digital transformation strategies.

Industry giants are already leading by example. Google aims to eliminate plastic from hardware product packaging by 2025, with Pixel 8 and Pixel 8 Pro packaging already using 100% plastic-free materials.

Besides building eco-friendly hardware, businesses will focus on designing carbon and energy-efficient software applications to minimise the impact of their digital operations on the environment.

6. Increased impact of 5G

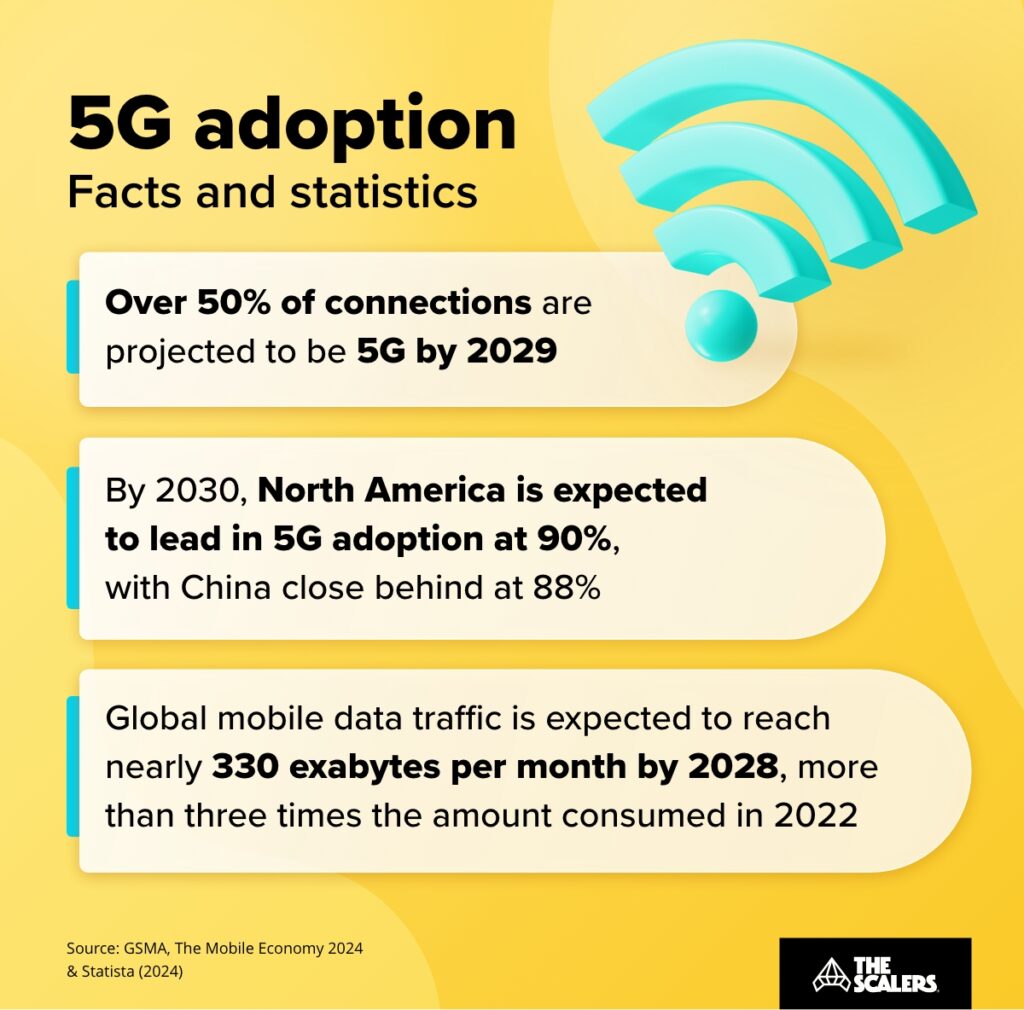

One of the few technologies rivalling AI for the title of ‘most talked about term’ recently is 5G. This 5th generation mobile network began deploying in 2019, but its adoption has yet to reach its full potential, which may occur in the next couple of years.

5G will play a crucial role in organisations’ digital transformation strategies, as it opens a whole world of possibilities for businesses to offer faster and better customer experiences.

That’s exactly what Tension and Onsite Sport are doing. Leveraging the power of 5G, the company has developed an app that offers a gaming-inspired interactive sports experience to its users.

7. AR/VR immersive experiences

There was a time when virtual reality was the next big thing, and many predicted that by now, people would live and interact in the metaverse as they do in the real world — a vision reinforced when Facebook rebranded to Meta.

Despite virtual reality experiences not being what everyone expected them to be, AR/VR experiences are starting to make a significant impact in some business areas. Particularly in the digitalisation of the travel industry.

A good example of this is how tourists who visit Singapore can explore the city through an immersive augmented-reality tour.

Investments in AR/VR in 2025 probably won’t be as big as the ones made in other fields like AI, but business leaders in sectors such as tourism and education will continue to explore the potential of this technology.

It’s worth mentioning that the biggest advancements in this space have come from wearables. Meta has released VR headsets like the Meta Quest, while Apple has introduced the Vision Pro.

8. Integration of Internet of Things (IoT)

IoT devices, such as wearable sensors, are changing the way we interconnect with systems and how we share and exchange information. Especially in the healthcare industry.

Healthcare institutions are expected to invest heavily in IoT gadgets, as the IoT medical devices market is set to grow from $41.5 billion in 2023 to $166.5 billion by 2028.

This technology is driving digital transformation in healthcare, enabling remote patient monitoring and helping doctors respond quickly to emergencies or life-threatening situations.

9. Adoption of edge computing

Edge computing is a distributed computing model that processes data closer to where it is generated, reducing latency and bandwidth use by bringing computation and data storage nearer to the end user or data source.

For example, your smartwatch can analyse your heartbeat and other metrics using its local processor instead of sending the data to the cloud for processing. This allows it to make instant exercise recommendations as you walk or run. That’s the advantage of edge computing.

The full adoption of this computing framework in all industries will likely come by the end of the decade as IoT devices and their integration with advanced analytics and AI/ML models become a priority for business leaders. However, by 2025, the shift in how data is processed and managed will begin to gain real momentum.

10. Use of blockchain in supply chain management

Blockchain technology is typically associated with cybersecurity, but it also has other applications, such as supply chain management.

Major players in industries like automotive are benefiting from the improved efficiency blockchain-based supply chain management systems offers them. Indeed, this technology is now a key focus for organisations undergoing digital transformation in the automotive sector.

The growth of the automotive blockchain market will skyrocket in the next decade: it was valued at $468 million in 2023 and is expected to reach a staggering $7.38 billion by 2032.

Besides automotive, blockchain is set to make logistics and shipping faster, safer, and easier for businesses of all sizes and industries.

11. Cloud migration

While cloud technology became mainstream in the mid-2000s, many business leaders still face significant hurdles in fully adopting it. In fact, 90% of organisations have encountered challenges on their cloud adoption journey over the past year.

Those who haven’t yet migrated to the cloud will accelerate their transition and drive cloud investments in 2025 to improve security and governance, increase scalability, and replace on-premises legacy technology.

To ensure the success of their cloud initiatives, businesses are expected to hire highly qualified tech talent like Cloud Architects and Cloud Systems Engineers.

Drive digital transformation with a unique offshore model

Although reskilling your team to undergo digital transformation can be a good move, your in-house talent may not always have the necessary expertise in certain technologies

That was Mediolanum’s case. This Dublin-based Asset Management organisation wanted to modernise their legacy IT and digitally transform it to deliver a world-class user experience.

However, hiring locally was not an option due to the shortage of skilled developers. That’s when they contacted The Scalers.

With our unique and proven offshore model, they could modernise and move faster with an elite tech team in Bangalore, India, one of the world’s most thriving tech hubs.

The value The Scalers deliver is long term — Mediolanum Bangalore is an extended part of our team, not individuals disconnected in a different part of the world. It’s been fantastic and much smoother than I could have imagined.

If you want to know more about The Scalers’ offshore model and how we can help you build a tech team with the top 1% of Indian tech talent, fill out this form and tell us your unique requirements. One of our senior executives will get back to you promptly!

If you want to see how our partners have succeeded — including similar digital transformation success stories to Medionalum’s — read our case studies featuring industry leaders like Preqin and Ykone.

In summary

It’s a wrap!

We hope you’ve found this article on digital transformation trends helpful, particularly if you are a business or tech leader looking to transform your organisation this year. In 2025, AI will still be a key driver, but other innovations like the ones analysed in this guide will also be worth checking out.

Key takeaways:

-

1

Generative AI will play a major role in shaping business decisions in 2025.

-

2

Quantum cryptography will revolutionise cybersecurity in the coming years.

-

3

Low-code and no-code platforms are enabling wider collaboration in app development.

-

4

Automation will take over repetitive tasks, boosting efficiency across industries.

-

5

Eco-conscious strategies will become a key focus in digital transformation plans.

-

6

5G will enhance customer experiences and drive business growth.

-

7

AR/VR will impact industries like tourism and education, offering immersive experiences.

-

8

The Internet of Things (IoT) will drive digital transformation, especially in healthcare.

-

9

Edge computing will gain momentum, offering faster data processing near the source.

-

10

Blockchain will improve supply chain management and enhance security.

-

11

Cloud migration challenges persist, but businesses will prioritise it for improved security and scalability.

To keep yourself informed on digitalisation and other topics, such as offshore development and tech leadership resources, make sure to keep an eye out for our upcoming blog content.

See you in the next one!

Build Your Team,

Not Just a Contract

With The Scalers’ offshore dedicated development team, you get engineers who join your workflow for the long run. Grow steadily, stay flexible, and work with people who care about the product as much as you do.