From Bangalore to Bucharest, the world’s top CTOs are increasingly looking abroad to solve the software development challenges they’re facing at home — namely, skyrocketing costs and a tough hiring market.

And the data doesn’t lie: A recent survey by Hays of 11,000 professionals in the UK found that talent retention (57% of respondents), the economic environment (51%), and recruitment (50%) are the top three challenges holding back businesses from achieving their delivery goals.

Eastern Europe and India have long been top destinations to build engineering teams while keeping overheads in check. Enterprises like HSBC and Tesco, and unicorns such as Revolut, Zilch, and Wise, have already extended their teams to these regions.

But it’s not just the big names. Small and mid-sized companies are also extending their teams abroad to accelerate delivery and get ahead of their competitors.

In our latest report, we compare Romania, Poland, and India using recent data and expert insights to give CTOs a clear view of where they should extend their teams offshore. You can download the report for free today.

How Eastern Europe and India compare across key parameters

CTOs who opt to hire Eastern European talent benefit from real-time collaboration given the closer time zones, as well as a high proficiency in foreign languages like German and French. Those who set up in India access far more cost-effective developer rates and the ability to scale faster thanks to the country’s massive talent pool.

Below are the key parameters we analysed in comparing the two regions.

Offshore ecosystem maturity

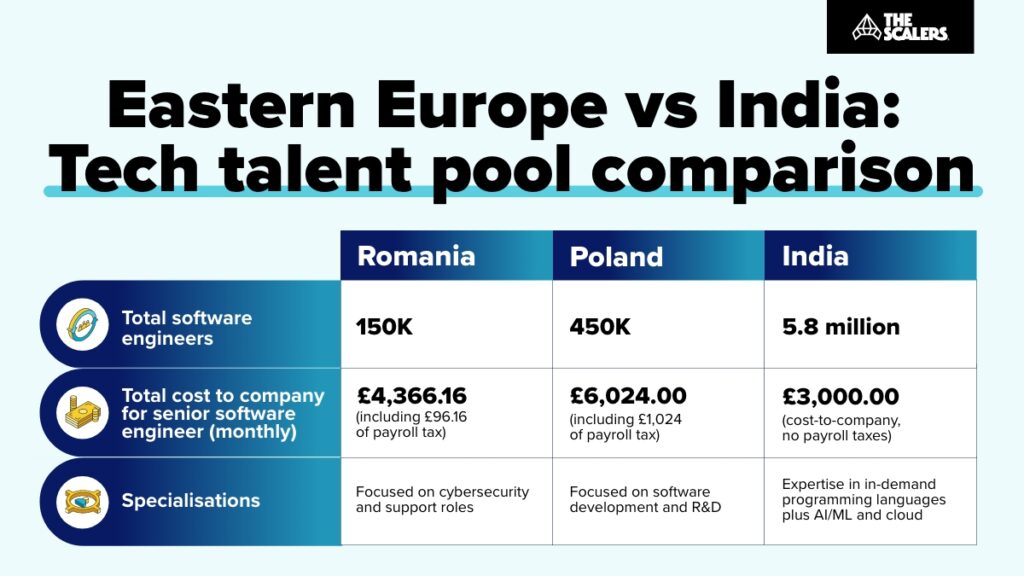

Romania has a strong but still maturing offshore development ecosystem, with 150+ Global Capacity Centres (GCCs) from some of the world’s largest companies. While the country does have some very high-quality engineering talent, a lot of global companies come to Romania for cybersecurity expertise and to hire customer service roles, thanks to Romanians’ strong command of foreign languages.

The engineering powerhouse of Eastern Europe is undoubtedly Poland, with over 400 GCCs. 1,500+ custom software development companies specialise in web, app, and AI development, and two-thirds of the country’s business centres focus on software development and R&D roles.

And then there’s India, which for decades has been the world’s #1 offshore development destination, currently home to over 1,800 GCCs. According to India’s National Association of Software and Service Companies (NASSCOM), India accounts for around 57% of the global offshore market. A 2025 Deloitte survey of organisations currently offshoring in India found that 90% have centred engineering, R&D, and product development roles in the country.

Cost effectiveness

Over the past decade, tech salaries have risen across Poland, Romania, and India. But how has this impacted each country’s competitiveness?

Across Eastern Europe, but particularly in Poland, the cost to hire is now nearing or matching costs in the UK due to appreciating salaries and high tax burdens.

The total monthly cost to hire a senior engineer in the UK is approximately £7,917 in 2025. In comparison, companies will spend £4,366 monthly in Romania (including £96 of payroll tax) and £6,024 in Poland (including £1,024 of payroll tax).

India has the lowest overall cost to the company: £3,000 with no payroll tax.

In terms of competitiveness, a 2025 survey by Poland’s Association of Business Service Leaders found that 93.5% of leaders in the country’s business services sector believe that high labour costs are weakening Poland’s attractiveness, and that gains in productivity and efficiency are not outpacing cost increases.

In fact, the Financial Express recently reported that Google is currently relocating its software engineering and quality assurance teams from Kraków to India, and IBM is also moving cloud services roles from Warsaw.

Tech salaries have also been appreciating in India at around 8-10% annually. Still, overall, India remains a much more cost-effective market than Eastern Europe for finding both the same quality of engineers and a wider range of specialised skills.

Talent pool size, depth, and quality

India has a larger talent pool with 5.8 million software engineers compared to Eastern Europe’s 2 million, with around 600K throughout Romania and Poland.

Both regions have very strong technical profiles that excel in the most in-demand programming languages in the UK today, including Python, SQL, JavaScript, and C#.

Each country also has a solid foundation in future-proof skills like AI, ML, and cloud. However, India is a much more mature market, boasting one of the largest and fastest-growing AI/ML talent pools globally.

While there’s a persistent myth that Indian engineers are not as good as European ones, this stereotype doesn’t reflect how the industry has matured over time, explains Emilien Coquard, The Scalers’ CEO & Co-Founder.

“When businesses started offshoring 45 years ago, they were looking for really, really cheap engineers. It was all about costs. But over time, tech leaders realised that prioritising savings above quality was creating really bad software. Now, expertise is key. Ten years ago, we would see companies setting up offshore teams of 500+ mediocre engineers to save money, but today businesses are building smaller and smarter, investing a bit more into top talent and getting a lot back.”

Both regions have talent that can help bridge the UK’s skills gaps, although India offers more opportunities for headhunting specialised profiles thanks to its huge talent pool. Eastern Europe is undoubtedly also home to world-class talent, but the region’s overall competitiveness is growing at a much slower rate.

For years, Romania has experienced a persistent brain drain with the best engineers looking for better working and living conditions throughout the EU and UK. Poland’s talent pool is growing steadily each year, but it’s getting much harder to hire specialised roles in the country. Poland’s Association of Business Service Leaders also found that 88.1% of respondents believed Poland’s top draw to be its skilled talent pool, but that 60% of companies have been unable to find the talent they need.

Language, culture, and communication

English proficiency is high among engineers in Romania, Poland, and India’s tech hubs.

In Poland, around 78% of IT talent speaks at a B2/C1 level. Romanians’ command of English is also strong, especially in Bucharest, which is home to half of the IT workforce. Romania also comes in as the second-most multilingual country in Europe after the Netherlands with a high percentage of French, Spanish, and Italian speakers, a potential benefit for companies that serve customers in these markets.

In India, English is one of the country’s official languages alongside Hindi. Around 70% of engineers have an English education through to the end of high school, and all courses are delivered in English at Indian engineering colleges. English is not only the lingua franca of international business but is also used among Indian engineers that come from different states to communicate both in and out of work.

In general, developers in both regions have a long history of working with international companies and are comfortable communicating in global tech environments.

Time zone and collaboration

Europe has an excellent time zone overlap with the UK, facilitating real-time collaboration between teams, while India has around half a day’s worth of overlap depending on daylight savings time.

That said, with the rise of remote and hybrid work, the standard 9-5 work day is losing its hold over companies and teams. In both Eastern Europe and India, it’s very standard for teams to work adjusted hours to match up with the schedules of their colleagues abroad, closing the time zone gap even more.

Get the report and find out what location best fits your business needs and goals

The ‘Eastern Europe vs India’ report is for you if you’re a UK business leader looking for more of these insights on where to build or extend your tech team.

What’s inside?

- A comparison of how Eastern Europe and India perform across key metrics like cost efficiency, offshore ecosystem maturity, and talent pool size and quality.

- A data-driven overview of which country leads in AI, ML, cloud, and full-stack development, and where you’ll find talent in languages like Python and JavaScript.

- Guidance on what to consider based on your company’s goals and overall roadmap to pick the best location for you.

Download your free copy and get the data you need to make an informed decision.

Build Your Team,

Not Just a Contract

With The Scalers’ offshore dedicated development team, you get engineers who join your workflow for the long run. Grow steadily, stay flexible, and work with people who care about the product as much as you do.