The Benelux region is stronger than its size. Despite only having 1.7% of the European territory and 5.6% of the European population, it accounts for 7.9% of European GDP. Its long history as a financial and cultural hub as well as its growing tech and startup scene are key to this success.

While the tech scene has helped grow the economy in recent years, it’s also accelerating the widening tech talent shortage in Benelux.

The situation is not hopeless.

Each country’s skill shortage is unique, as are the responses they have put in place, but the overall picture is the same. The Benelux region needs more skilled ICT professionals and they need them fast.

Perhaps it’s no wonder that more companies are investing in various offshore models to overcome these skills shortages. But are they the best option?

In this article, we’ll explore at the exact state of the challenge, the opportunities for those who can overcome it, and the path ahead.

Positive signs for the Benelux tech ecosystem

London, Paris and Berlin have typically dominated technology headlines, especially over investments. The Covid-19 pandemic and Brexit have disrupted that stronghold. One of the areas that has benefited the most has been the Benelux, comprisingcomprised of Belgium, The Netherlands and Luxembourg.

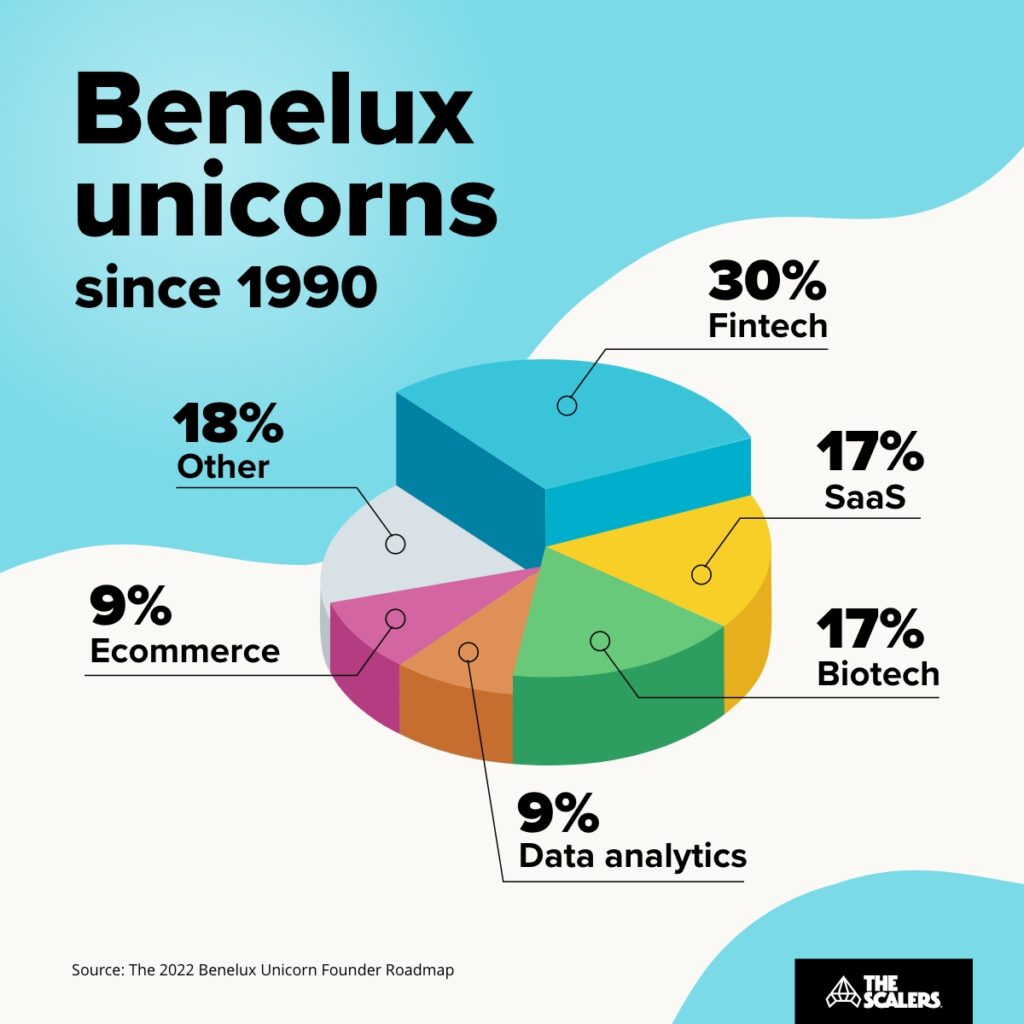

In 2021, VCs invested €4.7 billion in the Benelux tech scene, triple the amount compared to 2020. While it still doesn’t attract as much attention, nor investment, as its Western European rivals, the region is gaining a growing reputation for Fintech, clean energy, and health.

Here’s a breakdown of the unique factors and traits of each country’s tech ecosystem.

The Netherlands leads the region

The Netherlands is the top in Europe for digital skills [Eurostat].

Amsterdam has always been a strong tech hub with unicorns including Booking, MessageBird, Takeaway, and Adyen. In recent years, however, this growth has accelerated. In the aftermath of Brexit, significant European initiatives and investments have relocated to the Silicon Canals.

With Amsterdam’s Euronext replacing the London Stock Exchange as the top venue for share trading in Europe back in 2021, it’s become a prime location for the Fintech industry.

When combined with its existing tech hub status, large existing talent pool, and position at the top of EF’s English Proficiency Index (a measure of English skills globally) it is an attractive location for internal companies.

All of which explains why Amsterdam came second in the European Cities of the Future this year, and Startup Genome ranked it in the top 20 startup locations worldwide.

The Netherlands is more than just Amsterdam. And that’s reflected in the market.

Two-thirds of all startup jobs in the Netherlands are based outside the capital. Rotterdam has a thriving tech scene influenced by its port and large multinationals such as Shell. Eindhoven, Utrecht and Enschede are growing startup destinations thanks in part to their educational institutions and investments in research.

It’s no wonder that demand for tech skills is skyrocketing up and down the country.

How businesses can navigate the skills gap at home and scale quickly with offshore talent

DOWNLOAD WHITEPAPERBelgium’s governmental help and highly skilled workforce

Belgium’s multilingual identity and presence of European institutes have made it a multicultural hub for tech companies. This has helped Belgium attract a highly skilled workforce with a large migrant population. Plus, government programmes are helping drive business growth in clean energy, business services, and the digital economy sectors [Statistica].

This global character — especially in Brussels — helps explain why 76% of all Belgium startups are B2B focused. This has helped Brussels rise into the top four European regional challenges in the 2022 Startup Genome report.

Luxembourg’s wealth draws in talent

Although Luxembourg is the smallest member of the Benelux region, it has a key advantage. Its status as the second richest country in the world (GDP per capita) has made it a talent magnet for the surrounding regions — including France and Germany.

Multinational giants including Amazon and PayPal have their European headquarters here. They’re probably attracted to its multilingual heritage, large financial institutions, and importance within the European Union. In recent years, this has been boosted by several government-backed initiatives to encourage the tech sector.

The net effect?

Benelux currently boasts 33 unicorns and 21 soonicorns split between the three countries as well as countless more startups and scaleups. And these are powered by one of the highest developer-to-population ratios in the world.

But that growth has amplified its greatest challenge: skill shortages.

The challenge: tech talent shortages in Benelux

Demands for ICT professionals across Europe rose 57% between 2012 to 2022, and the Benelux is no exception.

But although demand has skyrocketed, the supply of employees hasn’t managed to keep up. This has led to high vacancy rates for ICT professionals in every member country.

The region suffers from the same factors that are driving global talent shortages. Demographic shifts, ongoing digitisation of legacy industries, and the rise of machine learning and generative AI have caused a surge in demand for IT professionals.

With the great resignation leading to a decrease in skilled workers and insufficient junior engineers joining the ranks, migration is becoming the only way to mitigate the demographic challenges.

The fourth industrial revolution was turbocharged by the Covid-19 pandemic. Now, almost every company is a tech company in some form and requires a team of engineers.

Advances in artificial intelligence are promising increased profit margins to those who can leverage them effectively. Something only possible with the limited pool of AI and data experts available globally.

There are, however, unique factors specific to the region and each country that are increasing demand and decreasing the supply of skilled engineers across Benelux.

Understanding these challenges is critical to devising an effective strategy to overcome these shortages and keep development on track.

The growing skills gap in Belgium

Belgium has done well in training and attracting ICT talent. It ranks in the top quarter of European countries for the forecast of ICT professionals in the population.

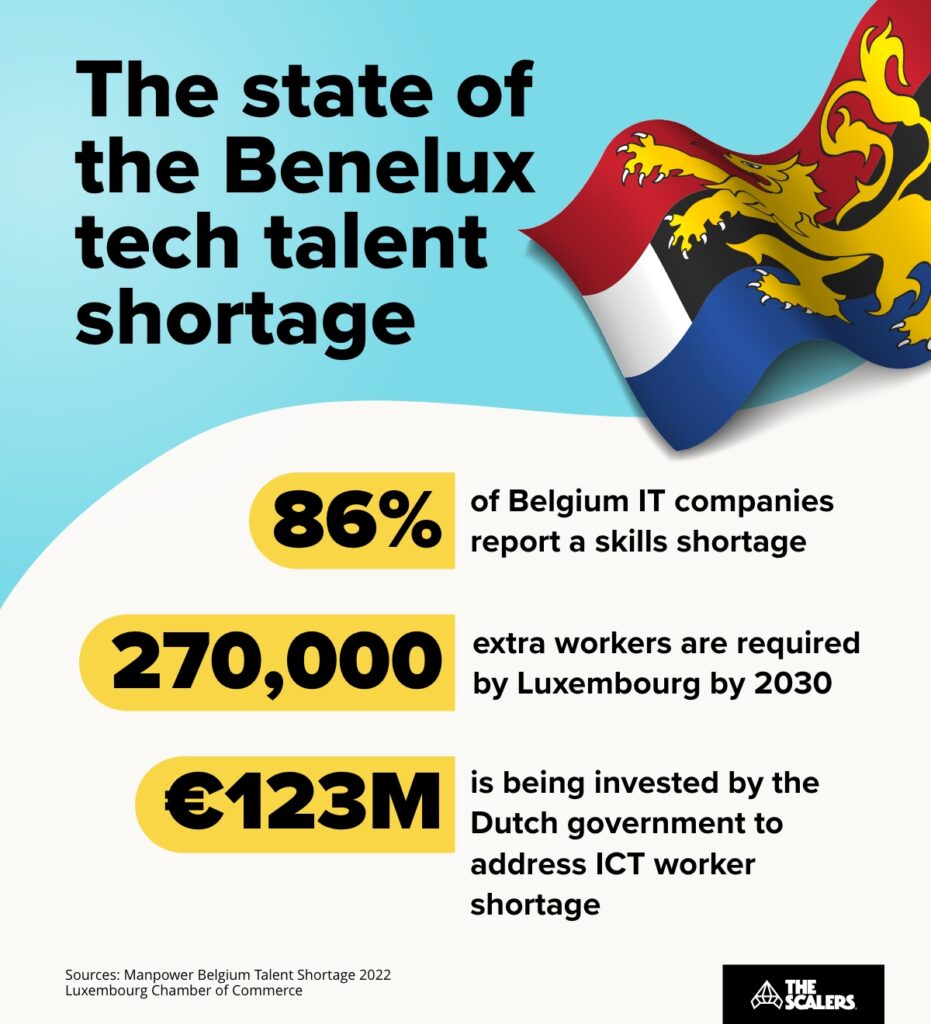

Yet despite the large developer scene, 86% of Belgian IT companies have reported staffing shortages, according to Manpower’s 2023 survey. This is evident in the 21,000 unfulfilled vacancies in Belgium’s tech sector as of November 2021.

The exact skill shortages vary by region.

- Brussels Capital Region: CTOs, heads of ICT departments, software engineers, and system analysts

- Flemish Region: integration and implementation experts, ICT business analysts, engineering team managers, and database administrators

- Walloon Region: Operation managers, software developers, web developers, and ICT analysts

Despite Belgium’s large and growing developer pool, it just can’t keep up with the skyrocketing demand.

IT skills shortages in the Netherlands

In 2022, the European Labour Authority reported that The Netherlands had the third-highest total skills shortage in Europe — just beating Belgium in fourth.

Korry Ferry’s global talent shortage report highlights the growing highly skilled tech talent gap in the Netherlands. This is predicted to grow by 2030, contributing to the massive unrealised revenue across Europe.

This has spurred the Dutch government to invest €123 million in initiatives to train more ICT employees. The goal is to fill the gaps in not only developers but also Data and security specialists in the region.

Developers knowledgeable in JavaScript, Java, SQL, C#, and Python are the most wanted with demand highest in the public services, ICT, fintech and consultancy industries.

The Dutch tulip bubble crash was caused by irrational demand. The potential tech crash will be due to a lack of supply.

The talent crisis in Luxemburg

Luxembourg is unique. Although small, it has large appeal due to its wealth, and importance within European institutions.

FEDIL, The Voice of Luxembourg’s Industry, commissioned a report on the ICT skills required by companies in Luxembourg. These were the top five forecasted hires for companies from 2022.

- Programmers (A broad category including front-end, back-end, cloud, integrators, and full-stack developers)

- Systems administrators

- Business analysts

- Network administrators

- Systems engineers

Demand for programmers was almost triple that of systems administrators in second place.

Unfortunately for Luxembourg, its demands for software engineers are exacerbated by its key challenge.

Luxembourg has a demographic time bomb on its hands. According to the Luxembourg Chamber of Commerce, the country needs an additional 50% of its workforce by 2030.

The country already relies heavily on foreign workers. As much as 70% of the existing workforce are not citizens. While European institutions have attracted migrants to the country, they also take talent within the country.

This severe staffing shortage is an extreme handicap to growing local tech teams. To tackle it, many companies in Luxembourg have already discovered the simple solution to scaling.

Scaling beyond borders

With talent shortage riff across Europe, even the benefits of freedom of movement and work within the EU provide light relief. The solution is obvious. Build a world-class tech team in a talent hotspot.

These offshore oases have an abundance of highly qualified residents ready to take on challenging projects.

Whereas offshoring used to be a way to save on costs with a low-value, project-based team, the global talent crunch has birthed a new breed of offshoring. Instead of hiring less qualified engineers, going offshore is increasingly becoming the key to finding experienced engineers with in-demand niche skills.

Discover how to scale development teams in 2023 and beyond

DOWNLOAD EBOOKAnd thanks to the tectonic shift in the way we work, catalysed by the Covid-19 pandemic, it’s never been easier to collaborate with a global team. Even the “challenges” brought on by multiple time zones can increase productivity.

The key factor between companies who evangelise offshoring versus those who swear it off?

Finding the right offshore partner.

Offshoring without the headaches

We’ve built, managed, and scaled over 75 offshore tech teams for clients around the world using our unique model.

Unlike other partners, we hire a team just for you, matching your exact specifications. By pulling from the rich labour market of Bangalore, India, we can find even the most niche of skills. There is a reason it’s known as the Silicon Valley of Asia after all.

Our 7-step recruitment process ensures you get the final say on every hire after we eliminate the 99% who don’t have the right hard or soft skills. You don’t get stuck with a team of anonymous from a bench, instead, you get genuine colleagues who are invested in the mission and culture of your organisation.

And it doesn’t stop once we’ve found the candidates. We handle all the hassle of managing a team.

- Admin

- Payroll

- Trainings

- Equipment

- Office space

- Team building

- And engagement activities

All taken care of by your dedicated Partner Success Manager and Chief Happiness Officer.

So you can focus on delivering your roadmap while we take care of the rest.

The results?

Positions that take months to fill in Western countries are closed in weeks. And staff stay on average four times longer than local ones. It means you’ve got a long-term and scalable team ready to deliver.

How we helped a Legal SaaS company scale its Ruby on Rails team to deliver a groundbreaking product

DOWNLOAD CASE STUDYReady to overcome the Benelux tech talent shortage?

The boom in the Benelux tech scene is only going to widen the skills gap. If your company doesn’t start tapping into talent reservoirs like Bangalore, then it will lose out to others who do. All it takes to get the ball rolling is to contact us and see if our model is the right fit.

That’s it for now, but if you’re not sure if offshoring is right for your company, check out this article on the benefits of offshoring.