Digital transformation has revolutionised the FinTech industry, making it more customer-focused and innovative. Initially, this led to surging profits and the emergence of thousands of new unicorns, but in recent years FinTech funding has been slashed. Now, both legacy financial services and disruptive startups are struggling to survive.

Some companies are choosing to accelerate their digital transformation to increase profits, while others are looking to keep pace while cutting overheads. Many, are choosing to partner with top financial software development partners to help them make the transition more smoothly.

To help you understand the state of digital transformation in FinTech and how your company can navigate not just the current AI disruption but the next one, we put together this article for you. It charts the current state of digital transformation in the fintech industry, the key technologies that are driving that change, and how to overcome the main obstacles of digital transformation.

Accelerating FinTech’s growth through digital transformation

The financial services industry has long been known for its traditional approach and slow adoption of innovation. While there have been a string of innovative financial technology startups since the dot-com bubble days, the COVID-19 pandemic was a changing point. The outbreak acted as a catalyst for rapid physical and digital transformation, compelling the FinTech sector to rise to the challenge of equipping businesses with robust computing systems.

This transformative period can largely be credited to the swift changes in consumer behaviour and the emergence of new patterns driven by a strong preference for cash-less and contact-less activities.

These shifts have forced adaptation within the industry to meet the evolving needs and expectations of customers. The latest FinTech stats reveal that the industry has undergone enormous growth with a compound average growth rate (CAGR) of 16.8%.

How digital transformation in FinTech empowers SMEs

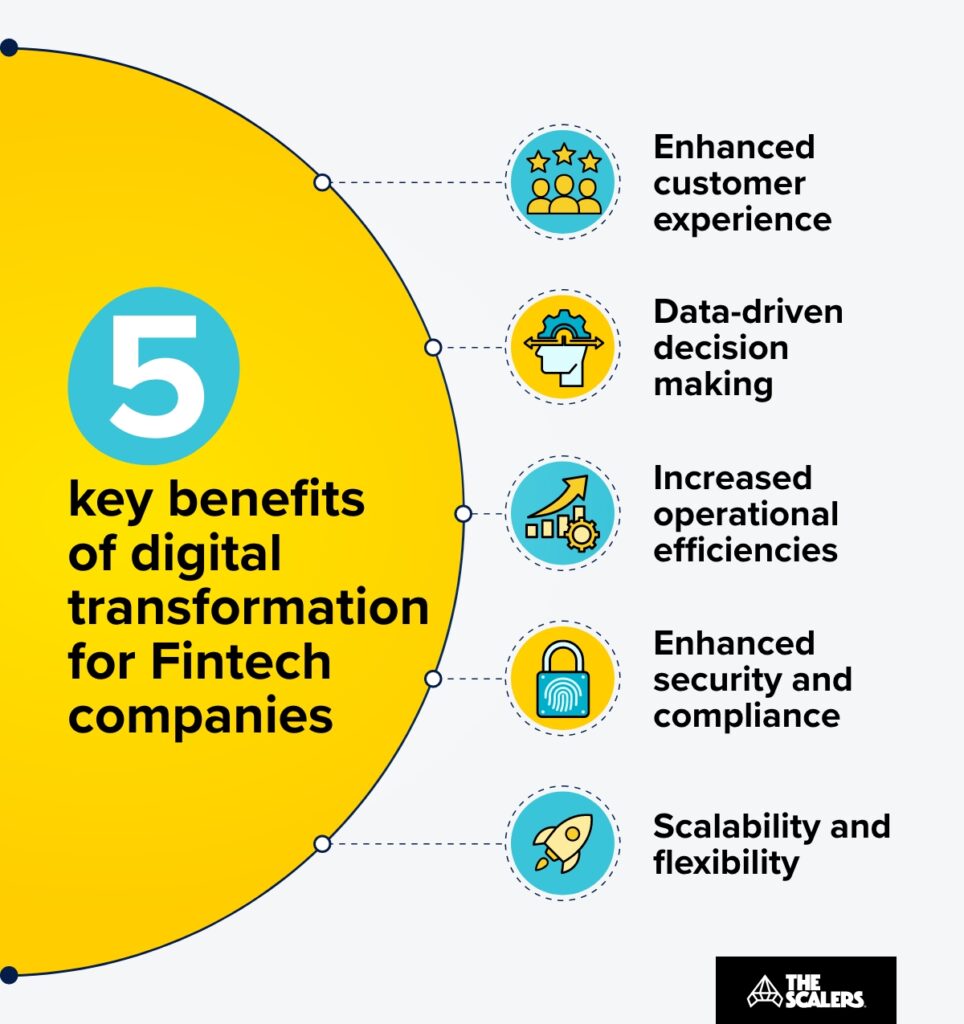

To ensure the competitiveness of your finance company and cater to consumer demands, it is essential to embrace digital finance initiatives that align with the pace of today’s innovation. With that said, let’s look at some of the main advantages of achieving more digital transformation in FinTech for small to medium-sized businesses (SMEs):

- Greater lending flexibility

- Channelling digital FinTech offerings

- Processing data for operational efficiency

- Simplifying complexities

- Enhanced access to capital

- Scalability and growth opportunities

- Real-time financial insights

- Seamless integration with partners

- Personalised customer experiences

- Risk mitigation and compliance

Digital transformation in FinTech enables the automation of various processes, allowing for faster and more efficient decision-making. By leveraging data analytics and artificial intelligence, financial institutions can quickly assess loan applications, evaluate creditworthiness, and make informed lending decisions, reducing turnaround time and improving customer satisfaction. Automation also streamlines back-office operations, such as document processing and compliance checks, leading to increased operational efficiency and cost savings.

What’s driving digital transformation in the financial sector?

Traditionally, financial services relied on face-to-face interactions due to the increased trust and security. With increased security for online transactions and changing customer expectations brought on by the transformation of other industries, that has changed.

The evolution of the FinTech sector has now become a critical business priority, aimed at enhancing customer experience through the introduction of innovative products and services.

The increasing demand for seamless and convenient financial services has fueled the drive for digital transformation in the FinTech industry. Customers today expect quick and easy access to their financial accounts, the ability to make transactions on the go, and personalised services tailored to their specific needs. To meet these expectations, FinTech companies are leveraging emerging technologies to improve efficiency and deliver a superior customer experience.

With the 2022 market correction leading to massive reductions at FinTech companies, there is a new focus on lowering overheads and increasing efficiencies. By embracing digital transformation, the FinTech sector is not only adapting to changing market dynamics but also positioning itself at the forefront of innovation in the financial services industry.

The latest digital transformation trends in FinTech

Amidst the widespread impact of the pandemic and the surge of digital transformation, the finance sector has undergone profound changes.

As technology continues to evolve and customer expectations continue to rise, it is crucial for FinTech companies to stay ahead of the curve and anticipate future opportunities and challenges. Here are just a few of the latest technologies and trends that are shaping the future of FinTech:

- Mobile banking — greater convenience

- AI and ML — automated decision-making

- Blockchain & crypto — streamlining financial processes

- Open banking & API — collaboration and data sharing

- Customer-centric digitalisation — enhancing user experiences

- Cloud computing — scalability, data storage, and flexible access

- Big data — driving data-driven decision-making

- Hybrid clouds — ensuring security, compliance, and efficiency

- Robotic process automation (RPA) — automating repetitive tasks

- Contactless payments — secure and convenient transactions

These trends encompass a range of technologies that have the potential to improve customer experiences and drive innovation. Organisations that leverage these trends will be better positioned to stay competitive and meet evolving customer expectations. While individual trends may not be relevant to your company, by exploring the direction of digital transformation, you can place your organisation in the best position for years to come.

Overcoming the obstacles of digital transformation in FinTech

The primary challenge faced by the FinTech sector lies in effectively presenting investors and stakeholders with a clear understanding of their proposition. This becomes particularly crucial when their offering deviates from the existing market norms or encounters resistance from a specific customer base. Such obstacles make it challenging to secure funding from commercial investors, who require compelling evidence that FinTech digital transformation is innovative and capable of mitigating risks to the greatest extent possible.

Building relationships and trust with clients who are accustomed to traditional financial services providers poses a significant hurdle for FinTech organisations. Overcoming the misconception that their innovations compromise security and data management is essential. To scale globally with minimal disruptions, FinTech companies require a supportive control framework that establishes boundaries. This framework is crucial in ensuring the financial resilience of the FinTech business.

These digital transformation challenges become even larger when a FinTech company attempts international expansion. The root cause of a company’s failure to scale stems from the inability of FinTech businesses to offer the technical solutions needed. However, the right offshore partner can play a crucial role in solving this challenge.

A good offshore partner can build the team you need for rapid digitalisation as well as provide valuable insights, help establish a strong market fit, and ensure compliance with local regulations, thereby increasing the chances of successful international expansion. By choosing the right offshore partner, FinTech companies can mitigate risks, enhance their market reach, and position themselves for sustainable growth in the global FinTech industry.

That’s exactly what happened for the Taxback group.

A transformation success story

The Taxback group was facing stiff competition from new digital-first entrants. Their existing team couldn’t keep up so they looked to establish a new offshore team to relaunch their flagship product and facilitate their digital transformation.

They partnered with The Scalers and established a new operating process to accelerate delivery and increase efficiencies. This new approach, working hand-in-hand with their central office led to the relaunch of their flagship product 6 months later and reestablished their market leader status.

The future of Fintech?

Digital transformation isn’t a one-and-done thing. It’s a constant process to find new improvements for companies and customers including those in the FinTech industry. While it’s impossible to predict with complete accurate what the next innovations and disruptions will be, we can be certain that they will come.

Leveraging offshore development centres means your FinTech will be able to navigate these changes smoothly and stay competitive in the process.

Key takeaways:

-

1

Digital transformation has revolutionised the FinTech industry, making it more customer-focused and innovative.

-

2

Digital finance initiatives empower SMEs with enhanced lending flexibility, operational efficiency, and personalised experiences.

-

3

Automation enables faster decision-making, improved loan assessments, and increased operational efficiency.

-

4

Future trends in FinTech include mobile banking, AI and ML, blockchain, open banking, and customer-centric digitalisation.

-

5

Overcoming challenges requires clear communication and trust while adhering to regulatory boundaries.

Whether your finance company is just starting its digital transformation journey or you’ve discovered you need assistance along the way, our expert offshore software developers can help. Get in touch with one of our offshoring experts to accelerate your transformation journey today.

FAQs

What is digital transformation in FinTech?

Digital transformation in fintech is about using modern technologies in the financial services industry to provide better outcomes, customer services, and increase efficiencies. The kind of technologies used include AI, blockchain, cloud computing and big data. Recent examples include neobanking, peer-to-peer lending services,

What are the four main areas of digital transformation?

The four main areas of digital transformation are business processes — making the business more efficient through automation/AI, business models — changing the way the company delivers value to its users, customer experience — offering better customer experience through personalisation and automation, and data and analytics — changing the mindsets and strategies in an organisation to adopt digital innovation.

What are the five pillars of digital transformation?

The five pillars of digital transformation are the essential elements required for a successful digital transformation. They include 1. Leadership and vision, 2. A culture of change, 3. Technology infrastructure, 4. Talent and training, 5. Data-driven decision making.

Build Your Team,

Not Just a Contract

With The Scalers’ offshore dedicated development team, you get engineers who join your workflow for the long run. Grow steadily, stay flexible, and work with people who care about the product as much as you do.